defer capital gains taxes without a 1031 exchange

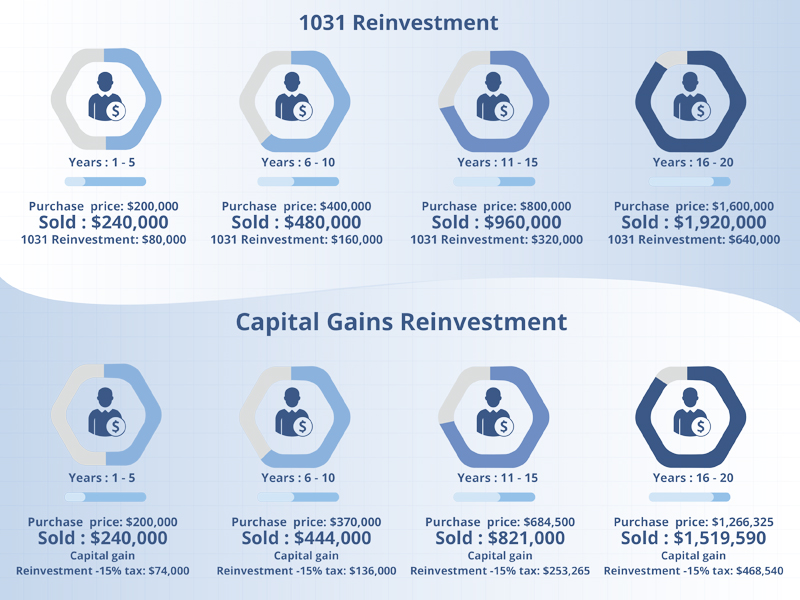

The timing of that tax payment however depends on what happens with the sale proceeds. You can continue to defer capital gains tax if you complete another exchange with your replacement property.

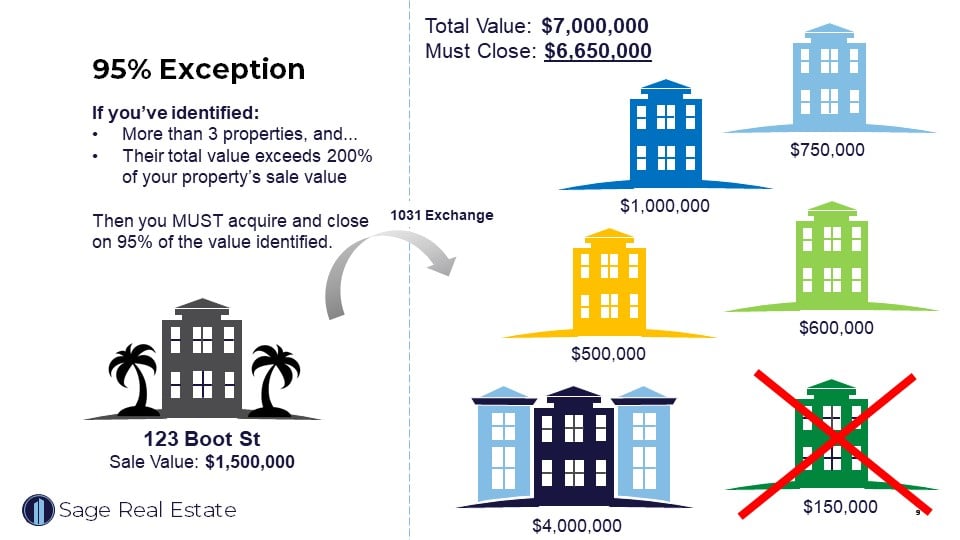

Deferring Capital Gains Taxes In Real Estate With A 1031 Exchange Everything You Need To Know Sage Real Estate

It doesnt eliminate your capital gains tax.

. Quite often owners of investment properties feel very stuck. Bretts company Capital Gains Tax. Or maybe youd like to have payments without incur.

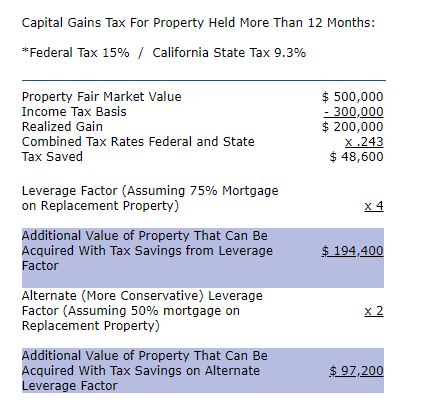

One of the major benefits of a 1031 exchange is that it allows you to defer paying capital gains tax which frees up all of your. The 1031 Exchange is the holy grail of tax deferral opportunities. Those taxes could run as high as 15.

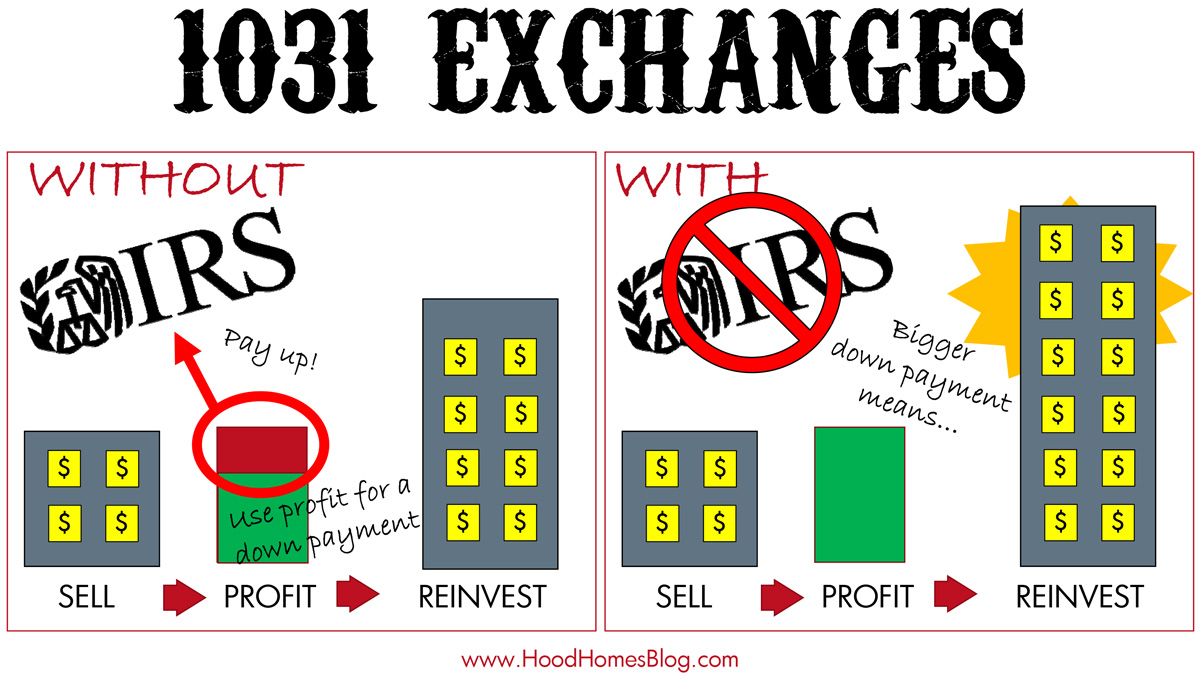

A 1031 exchange allows real estate investors to swap one investment property for another and defer capital gains taxes but only if IRS rules are met. This tax break allows you to swap out one investment property for another and defer the capital gains tax youd have to pay at the. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

This taxation is deferred indefinitely while you have ownership of the property. A 1031 Exchange is defined under section 1031 of the IRS code as a strategy that allows investors to defer paying capital gains taxes on any investment property. Real estate owners who seek the tax deferral benefits of 1031 exchanges and wish to avoid day-to-day management responsibilities often appreciate the advantages of DST co.

Those willing to reinvest and buy more property can defer the capital gains tax with. You must reinvest all the proceeds to defer paying tax on all the gain said. Under this method if you sell property or assets you convert the resulting gains into another investment property by purchasing a like-kind or.

We take a look at capital gains taxes and 1031. Many people want to know how much they are going to have to pay in capital gains taxes if they dont do a 1031 exchange. A 1031 Exchange Exchanges One Workload for Another.

A straightforward 1031 wont produce any income or give your bank account an injection of cash. The timing of that tax payment however depends on what happens with the sale proceeds. Specifically 1031 tax-deferred exchange stems from Section 11031 of the Internal Revenue Code which states that.

Deemed a powerful benefit for taxpayers and real estate pros one of the best ways to defer capital gains taxes is with a 1031 exchange of propertyas long as you dont mind managing your portfolio. Deferred all of his capital gains tax which would have been 580000. Moreover the DST can be used to defer capital gains taxes on high value assets such as a taxpayers business including goodwill that is typically not applicable to a 1031.

Without the 1031 exchange as vehicle for tax deference the capital gains tax could cop up to 15 to 20 of an investors profit on the sale of an investment property dependent. It is absolutely possible to defer capital gains tax on a DFW rental property using a 1031 exchangebut that doesnt make it the best way for investors looking to reduce their workload. By Margaret Flowers CPA.

Tired of tenants toilets and trash and dont want to purchase another income property warehouse or land. A 1031 Exchange allows you to delay paying your taxes. They would like to sell their highly appreciated property and use the funds for other options l.

The most common advice is to use the 1031 Exchange. It allows investors to defer 100 of their capital gains taxes as long as they reinvest their sales. No gain or loss shall be recognized on the exchange.

Its like having an interest free loan from the government. Deferring Capital Gains Taxes. Only if you never sell your 1031 exchanged property or keep on doing a 1031.

Selling an appreciated asset usually triggers a large capital gains tax obligation.

1031 Exchanges Explained The Ultimate Guide Cws Capital

Defer Capital Gains Taxes With Or Without A 1031 Exchange Youtube

Utilizing A 1031 Exchange To Avoid Capital Gains Taxes

Using The Deferred Sales Trust To Rescue A Failed 1031 Exchange Reef Point Llc

Defer Capital Gains Taxes Without 1031 Exchange

Defer Capital Gains Taxes Without 1031 Exchange

![]()

1031 Exchange Alternative Capital Gains Tax On Real Estate

Never Pay Taxes Again With The 1031 Exchange

Deferring Capital Gains Taxes In Real Estate With A 1031 Exchange Everything You Need To Know Sage Real Estate

1031 Exchange Alternative Capital Gains Tax On Real Estate

How Does A 1031 Exchange Work With Rental Properties

1031 Exchanges Rolling Over Funds Deferred Tax Strategy Makingnyc Home

New Page Marin County Exchange Corporation

Selling Your Investment Property Here S How To Defer Taxes With A 1031 Exchange Mansion Global

Everything You Need To Know About 1031 Exchange Rules Kw Utah Kw Utah

How To Defer Capital Gains Tax With A 1031 Exchange 1031 Crowdfunding

7 Rules Regarding 1031 Exchange